The S&P/ASX 50 (XFL) Index comprises Australia’s large-cap equites.

The index contains the 50 largest ASX listed stocks with the cut-off being a market capitalisation of ~$5billion (AUD). Constituents account for ~62% (September 2023) of Australia’s sharemarket capitalisation.

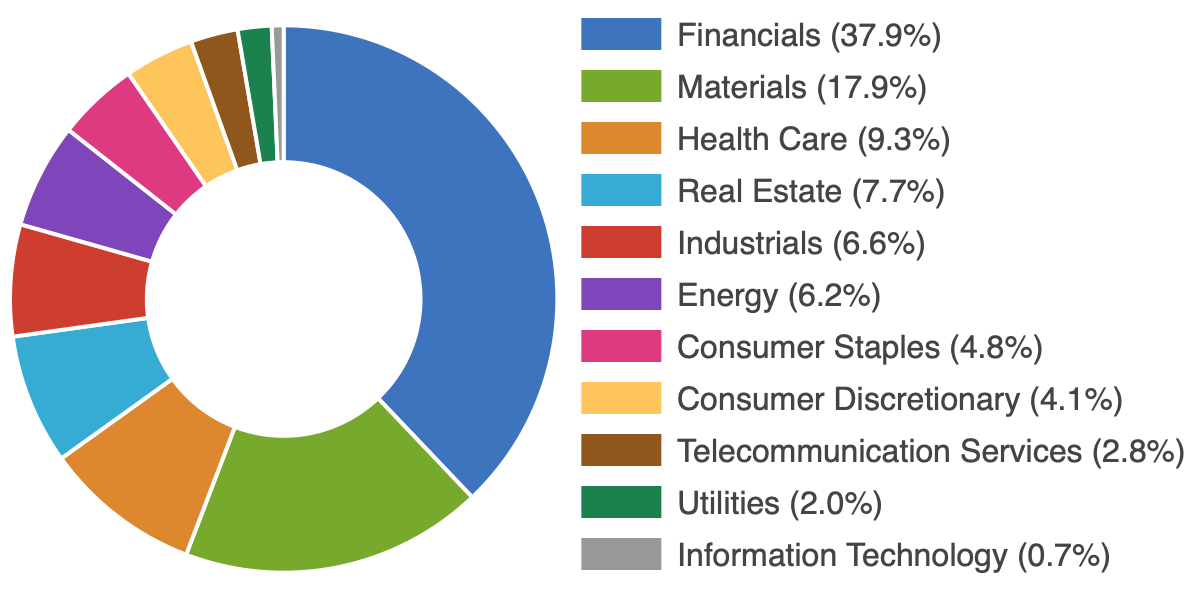

The ASX 50 is diversified between 10 GICS Sectors. Consumer Discretionary is the only sector not represented.

There’s currently one Exchange Traded Fund (ETF) that tracks the performance of the index: SPDR® S&P®/ASX 50 Fund (SFY).

IMPORTANT

IMPORTANTASX50list.com doesn’t provide share price data.

The best website is Market Index.

They have current ASX share prices, company charts and announcements, dividend data, directors’ transactions and broker consensus.

How are ASX 50 companies selected?

Constituents are selected by a committee from Standard & Poor’s (S&P) and the Australian Securities Exchange (ASX).

All companies listed on the Australian Securities Exchange (ASX) are ranked by market capitalisation. Exchange traded funds (ETFs) and Listed Investment Companies (LICs) are ignored. The top 50 ASX stocks that meet minimum volume and investment benchmarks then become eligible for inclusion in the index.

Rebalances are conducted quarterly in March, June, September and December. If a significant event occurs (e.g. delisting, merger, etc.) an intra-quarter rebalance may be conducted. A minimum of two business days’ notice is given to the market.

Skip to the ASX 50: Sector Breakdown | PE & Yield | ETF

Skip to the ASX 50: Sector Breakdown | PE & Yield | ETF

ASX 50 List (28 April 2021)

Click here for the current Share Prices (and Stock Charts)

The 50 largest companies by market capitalisation (includes ETFs & LICs) and not S&P constituents.

All S&P/ASX Indices use the Global Industry Classification Standard (GICS) to categorise

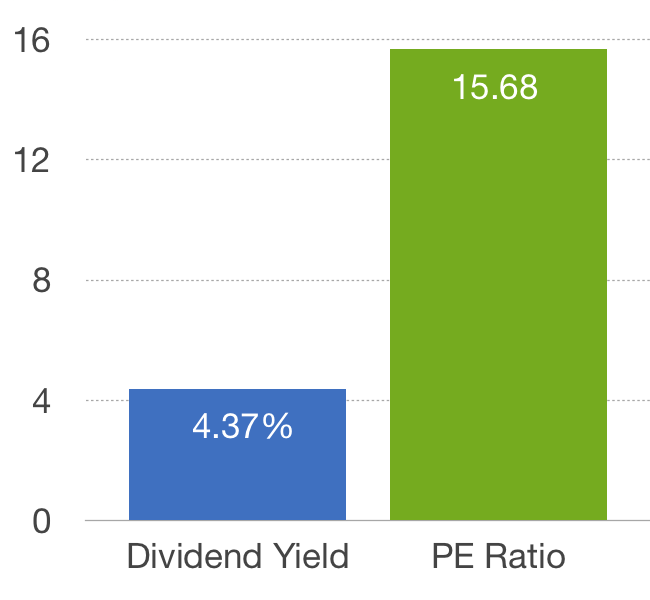

constituents according to their principal business activity. The S&P/ASX 50 Index contains all 11 GICS Sectors. Data updated: 1 March 2019 Fundamental data for the S&P/ASX 50 Index is weight-adjusted by market capitalisation. Companies with zero or negative values are ignored. Data updated: 1 July 2017 ETFs are managed funds that track a benchmark. They trade on the ASX like ordinary shares using

their ticker code. The goal of an index fund is to replicate the performance of the underlying

index, less fees and expenses. As at 10 October 2016, the SPDR® S&P®/ASX 50 Fund (SFY) is the only ETF that tracks the performance of the S&P/ASX 50 Index.

Code

Company

AIA Auckland International Airport Ltd ALL Aristocrat Leisure Ltd AMC Amcor Plc ANZ Australia and New Zealand Banking Group Ltd APA APA Group APT Afterpay Ltd ASX ASX Ltd BHP BHP Group Ltd BSL Bluescope Steel Ltd BXB Brambles Ltd CBA Commonwealth Bank of Australia COH Cochlear Ltd COL Coles Group Ltd CSL CSL Ltd DXS Dexus FMG Fortescue Metals Group Ltd FPH Fisher & Paykel Healthcare Corporation Ltd GMG Goodman Group IAG Insurance Australia Group Ltd JHX James Hardie Industries Plc MGOC Magellan Global Fund (Open Class) (Managed Fund) MGR Mirvac Group MQG Macquarie Group Ltd NAB National Australia Bank Ltd NCM Newcrest Mining Ltd NST Northern Star Resources Ltd QBE QBE Insurance Group Ltd REA REA Group Ltd REH Reece Ltd RHC Ramsay Health Care Ltd RIO RIO Tinto Ltd RMD Resmed Inc S32 SOUTH32 Ltd SCG Scentre Group SEK Seek Ltd SGP Stockland SHL Sonic Healthcare Ltd STO Santos Ltd SUN Suncorp Group Ltd SYD Sydney Airport TAH Tabcorp Holdings Ltd TCL Transurban Group TLS Telstra Corporation Ltd TPG TPG Telecom Ltd WBC Westpac Banking Corporation WES Wesfarmers Ltd WOW Woolworths Group Ltd WPL Woodside Petroleum Ltd WTC Wisetech Global Ltd XRO Xero Ltd Sector breakdown

PE Ratio & Dividend Yield

Exchange Traded Fund (ETF)

SPDR S&P/ASX 50 (SFY)

Manager:

State Street Global Advisors

Inception:

31 August 2001

Mgmt Fee:

0.286%

Fact Sheet:

Link